what is the tax rate in tulsa ok

The countys average effective property tax rate of 113 is above both the state average of 087 and the national average of 107. Tax rates sometimes referred to as millage rates are set by the Excise Board.

6765 Ralston Beach Circle Mortgage Mortgage Calculator Beautiful Homes

Tulsa County collects on average 106 of a propertys assessed fair market value as property tax.

. Single filers will pay the top rate after earning 7200 in taxable income per year. Yearly median tax in Tulsa County. Depending on local municipalities the total tax rate can be as high as 115.

4 rows The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa. Tulsa County OK Sales Tax Rate The current total local sales tax rate in Tulsa County OK. This is the total of state and county sales tax rates.

The City has five major tax categories and collectively they provide 52 of the projected revenue. State of Oklahoma - 45. Tulsa County in Oklahoma has a tax rate of 487 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa County totaling 037.

Learn Oklahoma tax rates for income property sales tax and more to estimate how much you will pay in 2022. Oklahoma state income tax rates range up to 5. The 2018 United States Supreme Court decision in South Dakota v.

Tax rates range from 025 to 475. Select the File Pay Online button above. What is the tax rate in Tulsa County.

Whether you are already a resident or just considering moving to Tulsa County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The Tulsa County sales tax rate is. Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402.

The Oklahoma state sales tax rate is currently. For the Single Married Filing Jointly Married Filing Separately and Head of Household filing statuses the OK tax rates and the number of. The County sales tax rate is 075.

2021 Tulsa County Tax Rates. Situated along the Arkansas River in northeast Oklahoma Tulsa County has the second highest property tax rates in the state. You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables.

A county-wide sales tax rate of 0367 is applicable. The median property tax in Tulsa County Oklahoma is 1344 per year for a home worth the median value of 126200. Detailed Oklahoma state income tax rates and brackets are available on this page.

Sales tax at 365. Oklahoma is ranked 972nd of the 3143 counties in the United States in order of the median amount of property taxes collected. Online You will need your new account number and PIN.

With six marginal tax brackets based upon taxable income payroll taxes in Oklahoma are progressive. By mail Make checks payable to the City of Tulsa and mail to the City of Tulsa Lodging Tax Processing Center 8839 North Cedar Avenue 212 Fresno CA 93720. Tax rate of 5 on taxable income over 12200.

2 to general fund. Did South Dakota v. County of Tulsa 2021 Levies Detail.

16 rows The Tulsa County Sales Tax is 0367. Some cities and local governments in Tulsa County collect additional local sales taxes which can. The Oklahoma sales tax rate is currently 45.

The Tuttle sales tax rate is 45. Taxes are based upon budgets submitted by taxing jurisdictions and include the amounts necessary to pay bonded indebtedness approved by a vote of the people. Tulsa County - 0367.

Tax rate of 4 on taxable income between 9801 and 12200. A county-wide sales tax rate of 0367 is applicable to localities in Tulsa County in addition to the 45 Oklahoma sales tax. Rates Effective January through March 2022 Updated.

Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. Has impacted many state nexus laws and sales tax collection requirements. The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is.

Learn all about Tulsa County real estate tax. This is the total of state county and city sales tax rates. The Oklahoma income tax has six tax brackets with a maximum marginal income tax of 500 as of 2022.

Tulsa S Black Wall Street Flourished As A Self Contained Hub In Early 1900s History

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Oklaed Supporters Are Already Making It Happening This Morning 48 Committed No Votes On Sb 407 No Thanks Privatization Michael Bennett Oklahoma Al Michaels

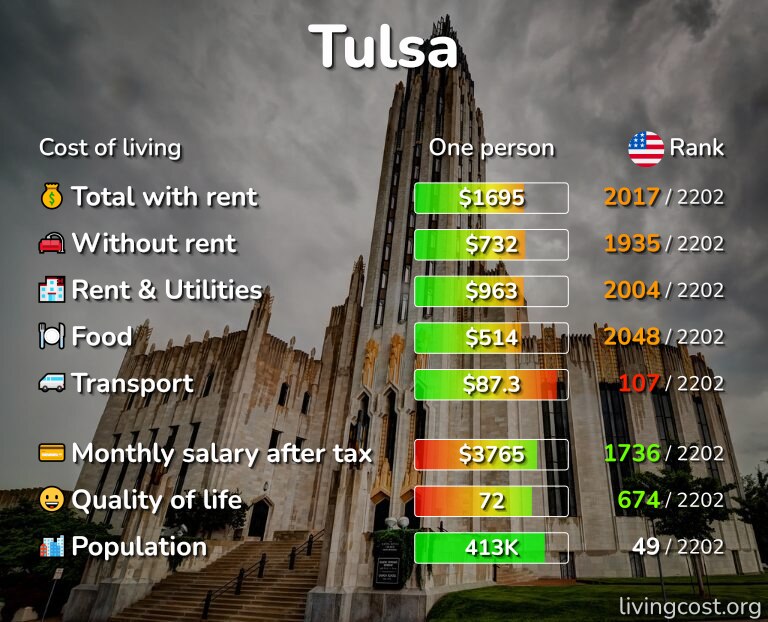

Tulsa Ok Cost Of Living Salaries Prices For Rent Food

Pros And Cons Of Living In Tulsa Ok Securcare Self Storage Blog

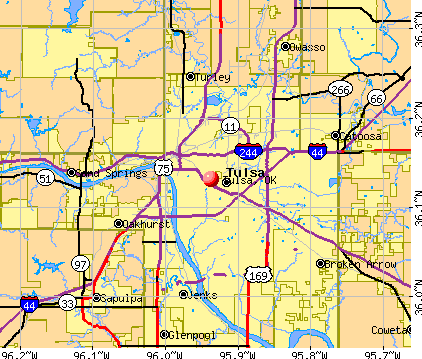

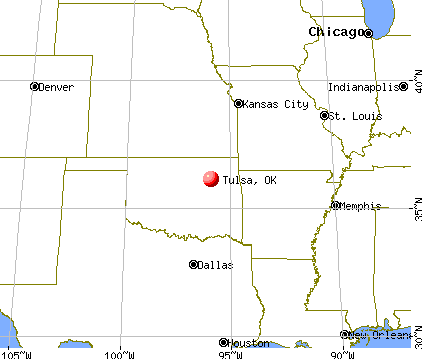

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

/cloudfront-us-east-2.images.arcpublishing.com/reuters/GX6ZHXBVVNMU5L2OBHVLSUTERE.jpg)

Gunman Kills Four In Oklahoma Medical Center Police Say Reuters

Tulsa County Oklahoma Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Best Mattress Stores In Tulsa Ok With Costs Reviews

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Owner Of A Masonry Business In Tulsa With More Than 30 Years 39 Experience In Restoring Historic Buildings Shelton Had Castle Historic Buildings Renovations

Tulsa Oklahoma Pictures Download Free Images On Unsplash